Chapter 6 Homework – OverPriced Jeans – Solid Footing 8e 2015-16

Chapter 6 Homework – OverPriced Jeans – Solid Footing 8e 2015-16 School Year

Workbook is Activated

Elevate Your Writing with Our Free Writing Tools!

Did you know that we provide a free essay and speech generator, plagiarism checker, summarizer, paraphraser, and other writing tools for free?

Access Free Writing ToolsFirst Name: Princess

Last Name: Sebo

ID Code: 07226430

Bruce Wiggett

ONLINE

Before you begin working, save your activated workbook

by following the directions in the SAVING YOUR WORKBOOK box >>

Instructions:

You will be recording the March 2015 transactions for OverPriced Jeans, Inc. (OPJ). After

recording the March transactions you will be preparing a Pre-Closing Trial Balance, Income

Statement, Calculation of Retained Earnings, Balance Sheet, and Post-Closing Trial Balance.

As you work on your workbook, be sure to save your file often.

You are given the following:

_ March transactions and Additional Information — Trans tab

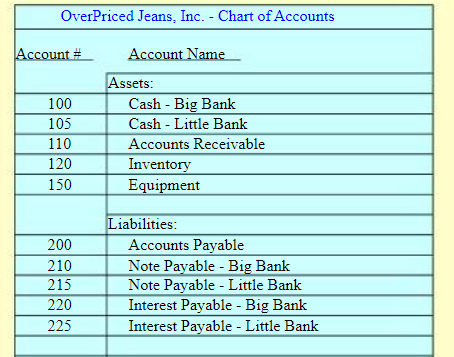

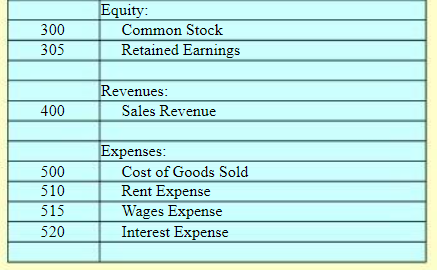

_ Chart of Accounts with Account Numbers and Account Names — Chart Accts tab

_ General Journal pages — Journal tab

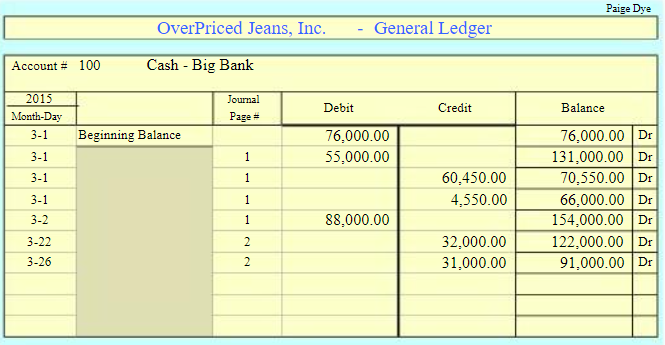

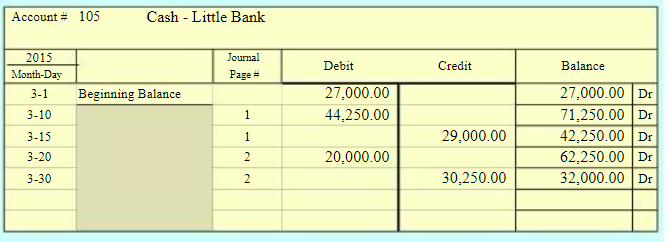

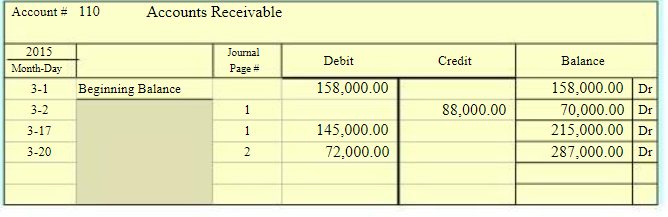

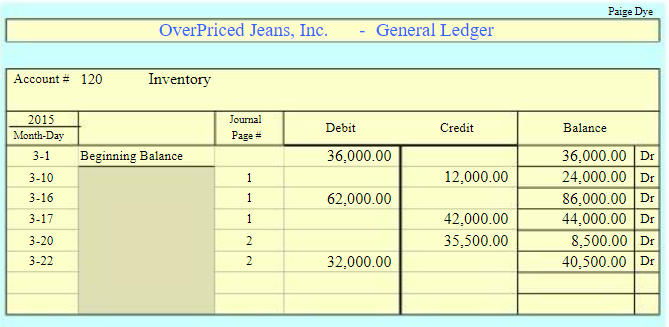

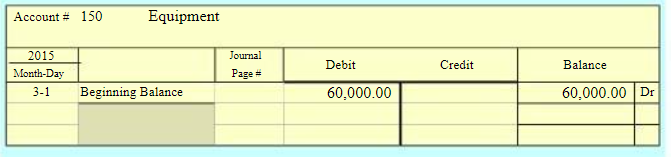

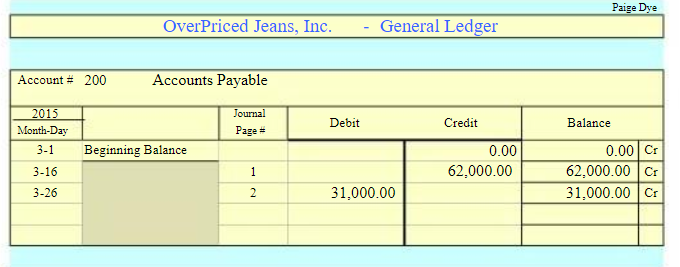

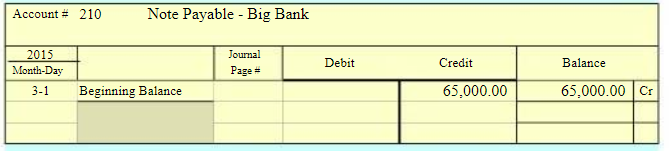

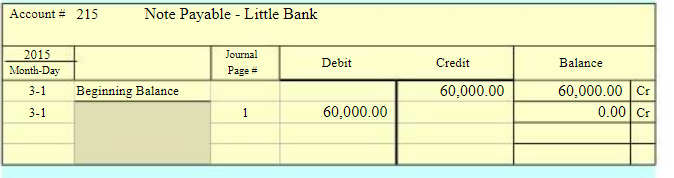

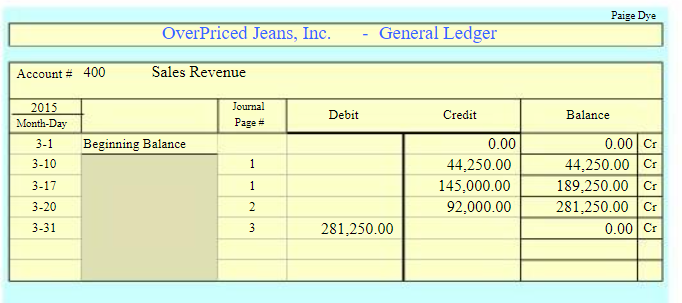

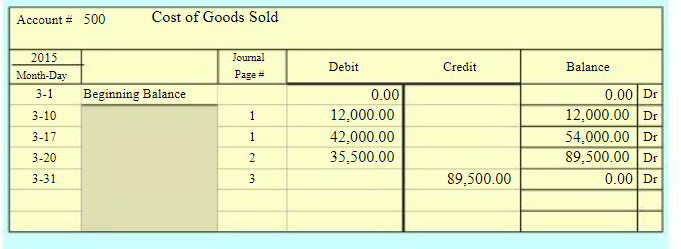

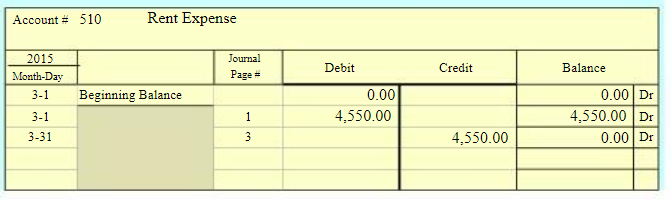

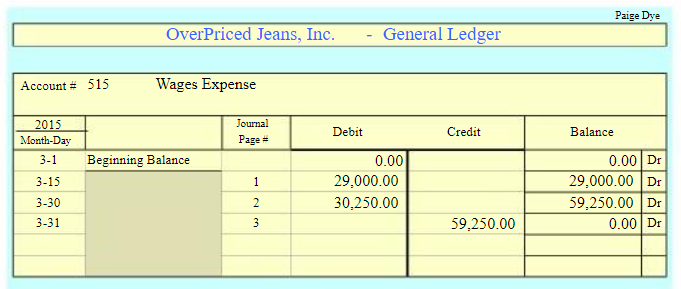

_ General Ledger — GL Assets, GL Liab-Equity, GL Rev-Exp tabs

_ Forms for the March 31: Pre-Closing Trial Balance, Income Statement,

Calculation of Retained Earnings, Balance Sheet, and Post-Closing Trial Balance

Trial Bal, IS & RE, BalSht, and Post Close TB tabs

To Complete Your Workbook do the following:

_ Print the March Transactions (click the Trans tab and then click the Printer Icon)

Use YOUR Transaction sheets — do not use another student’s sheets

_ Print the Chart of Accounts (click the Chart Accts tab and then click the Printer Icon)

000322885

SAVING YOUR WORKBOOK — Immediately after Activation

Save your workbook in a file that uses your name as the file name. The file name should be in

the form: LastNameFirstName-HW6.xls For example, Mary Smith would save her workbook

with the file name SmithMary-HW6.xls

Windows Excel 2013, Excel 2010, and Excel 2003, follow these directions:

– Click File

– Click Save As

– Excel 2013 only: Click Solid Footing 8e 2015-16 under Current Folder

– In File name: enter LastNameFirstName-HW6.xls

– Click Save

Windows Excel 2007, follow these directions:

– Click the Office Button in the upper left corner of your screen

– Point to Save As

– Click Excel 97-2003 Workbook

– In File name: enter LastNameFirstName-HW6.xls

– Click Save

Any time you save your workbook, if Excel 2007 asks you: Do you want to increase the security

of this document by converting to an Office Open XML format? Always click No

Mac Excel 2011, follow these directions:

– Click File

– Click Save As

– In Save As: enter LastNameFirstName-HW6.xls

– Format should be Excel 97-2004 Workbook (xls)

– Click Save

– Always Click Continue to the message X “This workbook contains features that will not ….”

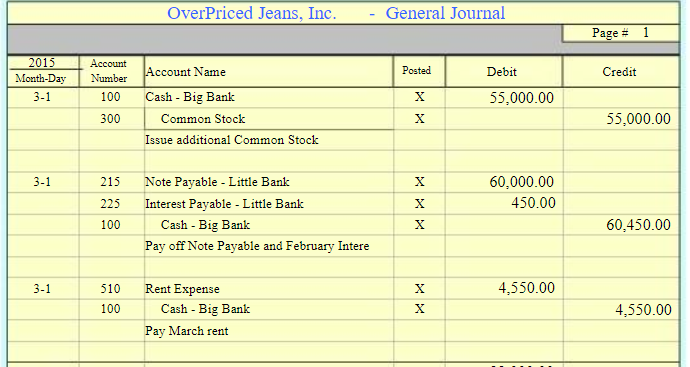

_ Record the March transactions in the General Journal. Click the Journal tab and record

your entries directly into the General Journal. Look at the March 1 Common Stock

transaction, which has already been entered, for an example of how to make your entries.

Do not put the “X” in the Posted column at this time. Use the printed Chart of Accounts

as a reference source for the Account Numbers and Account Names that are available

in OPJ’s accounting system.

_ To make posting from the General Journal to the General Ledger easier, it is recommended that

you print the General Journal — click the Journal tab and then click the Printer Icon.

Steps 1 and 2 in the Accounting Cycle

Step 1

For each business transaction that occurs during the accounting period, determine the effect of the transaction on the General Ledger accounts.

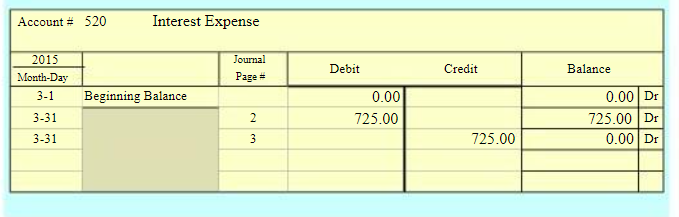

_ Post the entries from the printed General Journal to the General Ledger accounts. Click the GL Assets, GL Liab-Equity, and GL Rev-Exp tabs to find the accounts to be posted. Record your postings directly into the General Ledger. As you post an amount to an account be sure to enter the General Journal Page # into the Journal Page # column. See the first posting to the Cash-Big Bank account for an example. After you post an amount to a General Ledger account, then hand write an “X” in the Posted column of the printed

General Journal. This will help you keep track of which entries you have posted.

_ Enter the “X”s, which you hand wrote on your General Journal pages, into the General Journal. Click the Journal tab and enter the “X”s in the Posted column

Step 2

Make an entry in the General Journal for each transaction and post the entry to the General Ledger accounts.

Pg. 2

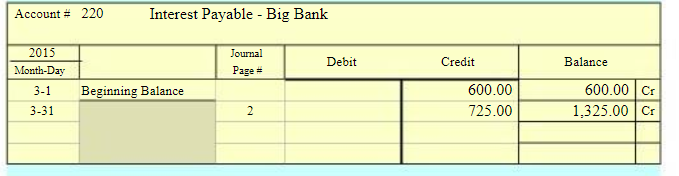

_ Prepare the March 31 adjusting entry for interest due on the Note Payable to Big Bank. The information for this adjusting entry is under the heading “Additional Information” on the page that printed when you printed the Trans tab. Click the Journal tab and record the adjusting entry in the General Journal. Use the printed Chart of Accounts as a reference source for the Account Numbers and Account Names that are available in OPJ’s accounting system.

_ Post the adjusting entry from the General Journal to the General Ledger accounts. Click the GL Liab Equity and GL Rev-Exp tabs to find the accounts to be posted. As you post an amount to an account be sure to enter the General Journal Page # into the Journal Page # column. After you post an amount to a General Ledger account, click back on the Journal tab and enter an “X” in the Posted column of the General Journal.

Step 3 In the Accounting Cycle

At the end of the accounting period, before preparing the financial statements, determine if any of the General Ledger account balances need to be adjusted. Enter any required adjusting entries into the General Journal and post the adjusting entries to the General Ledger accounts.

_ Print OPJ’s General Ledger by: clicking the GL Assets tab and then clicking the Printer icon, clicking the GL Liab-Equity tab and then clicking the Printer icon, and clicking the GL Rev-Exp tab and then clicking the Printer icon.

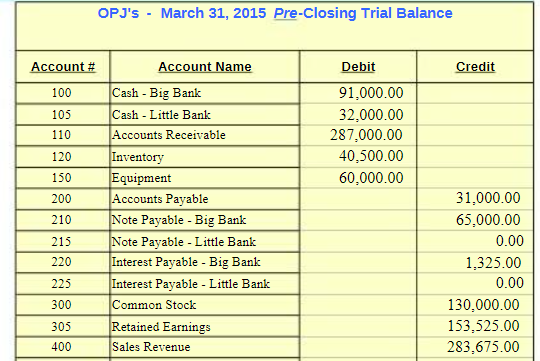

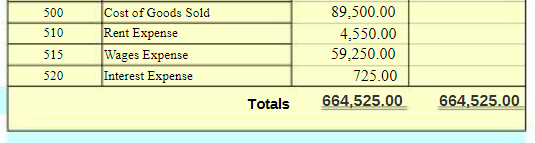

_ Using the printed General Ledger, enter the ending account balances into the March 31 Pre-Closing Trial Balance. Click the Trial Bal tab and enter the amounts into the Pre-Closing Trial Balance. Print the March 31 Pre-Closing Trial Balance by clicking the Printer icon.

Step 4 in the Accounting Cycle

Prepare a Pre-Closing Trial Balance to determine that the accounts in the General Ledger are in balance.

Step 5 in the Accounting Cycle

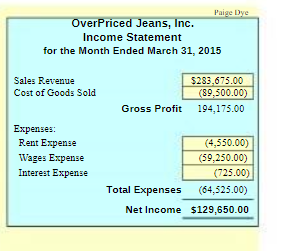

_ Using the printed March 31 Pre-Closing Trial Balance, prepare the March 2015 Income Statement. Click the IS & RE tab and enter the amounts into the Income Statement.

Prepare an Income Statement from the ending balances in the General Ledger revenue and expense accounts.

Step 6 in the Accounting Cycle

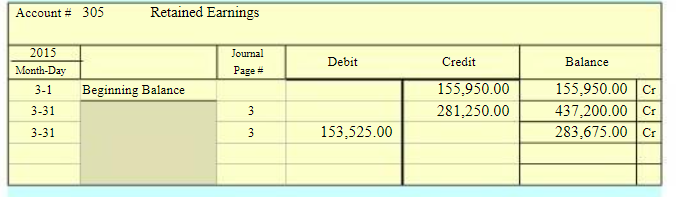

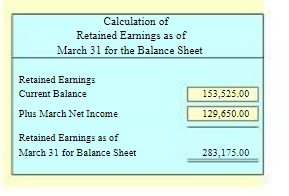

_ Using the printed Pre-Closing Trial Balance and the Net Income amount, prepare the Calculation of Retained Earnings as of March 31 for the Balance Sheet. Click the IS & RE tab and enter the amounts into the schedule.

Calculate the ending balance of the Retained Earnings account that is needed for the preparation of the Balance Sheet.

Step 7 in the Accounting Cycle

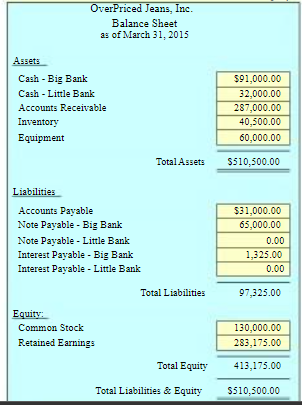

_ Using the printed March 31 Pre-Closing Trial Balance and the amount from the Calculation of Retained Earnings as of March 31, prepare the March 31, 2015 Balance Sheet. Click the BalSht tab and enter the amounts into the Balance Sheet.

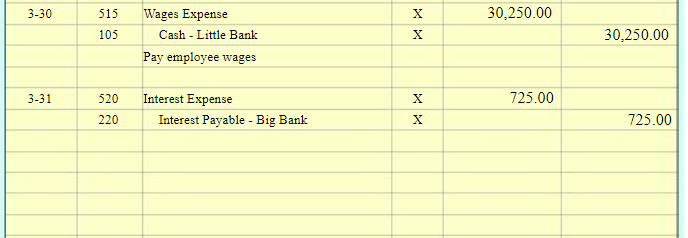

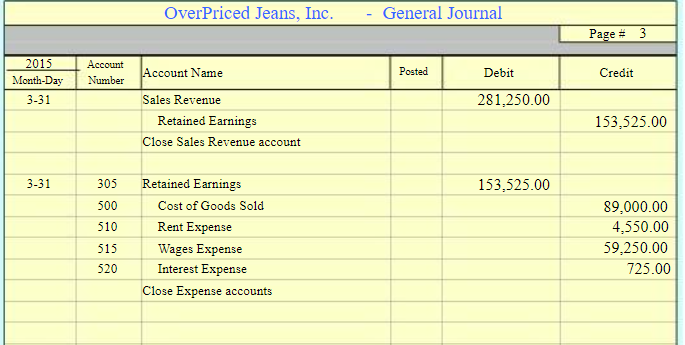

_ Prepare the closing entries. Click the Journal tab and enter the closing entries into the General Journal. Place your closing entries on Page # 3 of the General Journal.

_ Post the closing entries from the General Journal to the General Ledger accounts. Click the GL Liab-Equity, and GL Rev-Exp tabs to find the accounts to be posted.

As you post an amount to an account be sure to enter the General Journal Page # into the Journal Page # column. After you post an amount to a General Ledger account, click back on the Journal tab and enter an “X” in the Posted column of the General Journal.

Prepare the Balance Sheet from the ending balances in the General Ledger asset accounts, liability accounts, Common Stock account, and the calculated ending balance for the Retained Earnings account.

Step 8 in the Accounting Cycle

Prepare and enter the revenue and expense closing entries into the General Journal, and post the closing entries to the General Ledger accounts.

Step 9 in the Accounting Cycle

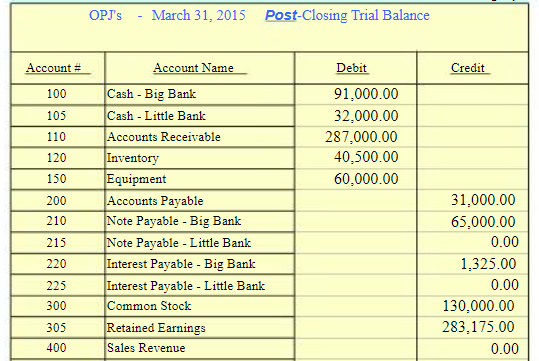

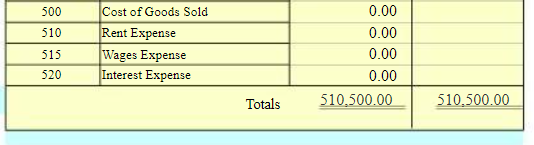

_ Click the Post Close TB tab and prepare the March 31 Post-Closing Trial Balance.

Your workbook is complete!

Your instructor will provide you with directions on how to submit your workbook.

Prepare a Post-Closing Trial Balance to determine that the accounts in the General Ledger are in balance and ready to start a new Accounting Cycle.

OverPriced Jeans, Inc. – Transactions – Additional Information

March 2015 Transactions

Date

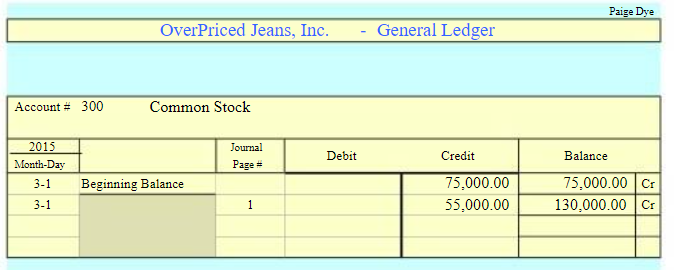

March 1: Owners of OPJ invested an additional $55,000 cash into the business. The cash is put into Big Bank. (As an example of how to journalize and post a transaction — this transaction has already been entered into the General Journal and posted to the General Ledger.)

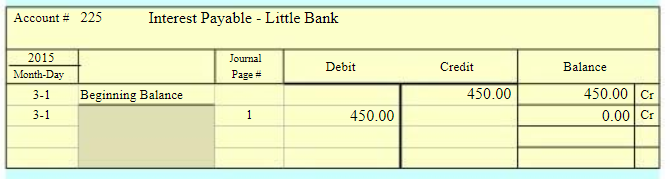

March 1: Pay off the $60,000 Note Payable owed to Little Bank. The cash to pay off the note is taken out of Big Bank. Also pay to Little Bank $450 for interest owed on the Note Payable for February.

The $450 cash is also taken out of Big Bank.

March 1: Take $4,650 cash out of Big Bank to pay for March’s rent.

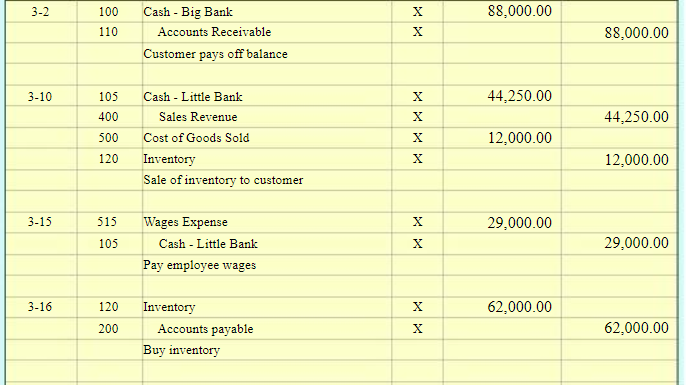

March 2: The customer that purchased on credit on February 15 pays $88,000 cash to pay off

the amount due. The cash is deposited into Big Bank.

March 10: Sale of inventory to a customer — selling price $46,250 — cost of the inventory sold $12,000. The customer pays cash. The cash is deposited into Little Bank.

March 15: Take $29,000 cash out of Little Bank to pay employees for wages they have earned.

March 16: Purchase $64,000 of additional inventory. OPJ will pay the manufacturer 50% of the $64,000

in 10 days. OPJ will pay the remaining 50% in 30 days.

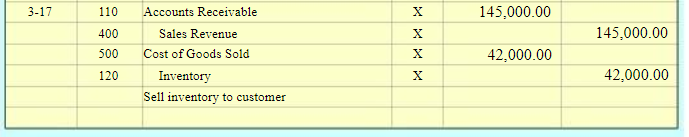

March 17 Sale of inventory to a customer — selling price $144,000 — cost of the inventory sold $42,000.

The customer will pay for the purchase in 30 days.

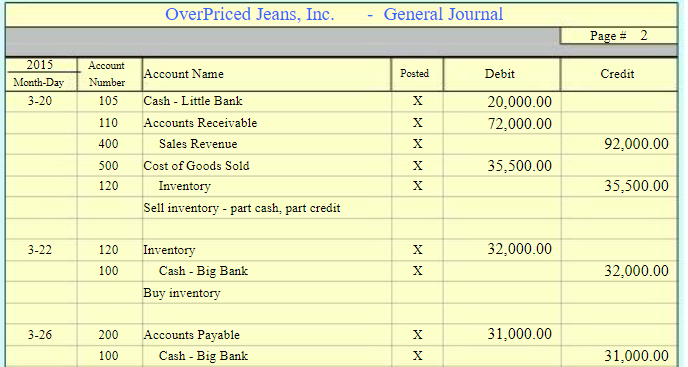

March 20: Sale of inventory to a customer — selling price $92,000 — cost of the inventory sold $34,500.

The customer pays $20,000 cash that is deposited into Little Bank. The customer will pay the

remaining amount in 30 days.

March 22: Purchase inventory for $32,000 cash. The cash is taken out of Big Bank.

March 26: Pay the manufacturer the 50% due on the March 16th purchase of inventory. The cash is taken

out of Big Bank.

March 30: Take $31,250 cash out of Little Bank to pay employees for wages they have earned.

Additional Information

Note Payable Big Bank: Interest due to Big Bank on the Note Payable for the month of March is $525. As of March 31 OPJ owes Big Bank a total of $1,125 for interest ($600 for February + $525 for March).

Interest will be paid to Big Bank in June.

PHY 211 questions on; an arrow is shot at an angle.

OverPriced Jeans, Inc. – Chart of Accounts

Special offer! Get 20% discount on your first order. Promo code: SAVE20