Suppose Purely Competitive Firms Producing Cashews Discover P Exceeds Mc

Suppose that purely competitive firms producing cashews discover that P exceeds MC.

a. Is their combined output of cashews too little, too much, or just right to achieve allocative efficiency?

(a)too little

Elevate Your Writing with Our Free Writing Tools!

Did you know that we provide a free essay and speech generator, plagiarism checker, summarizer, paraphraser, and other writing tools for free?

Access Free Writing Tools(b)too much

(c)just right

Answer; (a) too little

Explanation: It will be too little, to achieve the level of efficiency because, under a perfectly competitive situation, allocative efficiency could be achieved at the point where the price is equal to MC. When the price exceeds MC, the marginal utility of the buyers will fall and it will be less than the marginal cost.

b. In the long run, what will happen to the supply of cashews and the price of cashews?

(a)Supply will increase and the price of cashews will increase.

(b)Supply will increase and the price of cashews will decrease.

(c)Supply will decrease and the price of cashews will decrease

(d)Supply will decrease and the price of cashews will increase.

Answer; (b) Supply will increase and the price of cashews will decrease.

Explanation: In the long run, the supply of cashews will increase as seeing the economic profit due to the rise in the price of cashews more sellers will enter the market. As, the supply of cashews increases in the market, the price of cashews will decline. Thus, the price falls back to the position where it equals marginal cost.

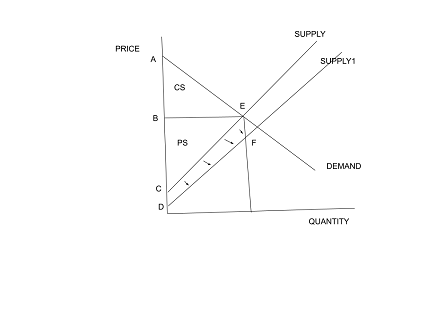

c. Use a supply and demand diagram to show how that response will change the combined amount of consumer surplus and producer surplus in the market for cashews.

What is Perfect Competition?

It is a theoretical market structure where all consumers and producers have even and complete information, and there are no transaction costs. In the real-world market, perfect competition hardly occurs, but it provides an effective model of explaining how demand and supply affect behavior and prices in a market economy.

There are many vendors and buyers in perfect competition, and prices reflect demand and supply. Organizations earn enough profit only to keep them in business and no more. If there is a possibility to pocket excess profit, other companies will drive the profit down by venturing into the market.

How Does a Perfect Competition Work?

Perfect competition is an ideal type or benchmark to which real-life market structures are compared. In perfect competition, all companies sell the same products, the market share does not influence the price, and companies can enter and leave without barriers; consumers have complete information, and companies do not determine the costs.

For example, assume a car market where each dealer sells the same type of car. The differentiation between each vehicle is little or none as they use the same procedure and sell at the same price. Still, few sellers can participate in the market freely without any barriers. In this scenario, consumers would have full knowledge of how they make their products and any other relevant information related to the product.

Characteristics of Perfect Competition

The following are factors that define a perfect market.

- A homogeneous and large market

A perfect market has a large number of consumers and sellers. Instead of enormous corporations capable of controlling market prices through adjusting supplies, the sellers at the perfect market are small firms. Their products have a minimal difference in capabilities, pricing, and features. It ensures the consumer cannot differentiate between the products based on physical characteristics such as color, size, or branding.

Due to a large number of sellers and buyers, the demand and supply in the market remain constant. As a result, it is easy for consumers to substitute products from one firm to the other.

- Perfect information

All the producers and consumers have the product prices and information about the advantages they will have by purchasing each product. It shields companies from having information that will give them a competitive edge over the consumer.

- Lack of controls

In an imperfect market, government plays a crucial role in product market formation by imposing price controls and regulations. They can regulate the firm’s entry and exit into the market by setting rules to be followed. For instance, the pharmaceutical industry has many laws regarding development, production, and drug sale.

In a perfect market, such controls are absent. There are no regulations for the entry and exit of firms in the market. So, they can spend on capital and labor assets without limitations and control their output by examining the market demand.

- No transaction cost

The consumers and vendors do not incur the cost when exchanging goods.

- Perfect factor mobility

All market production factors have perfect mobility and are not limited by any market forces. This allows employees to move between companies.

Barriers to Entry Prohibit Perfect Competition

Many manufacturing firms have notable entry barriers like high start-up capital in auto manufacturing or government restrictions in utility industries that restrict the firm’s ability to enter and leave such sectors. Although buyer alertness has increased with the information age, there are still some industries where consumers are aware of all products available and prices.

Significant barriers exist that prevent the economy from having perfect competition. The agriculture industry exhibits some close characteristics of perfect competition as it is distinguished by many small producers with no capability to alter their products’ selling prices.

The agricultural commodities commercial consumers are well informed, and although there are some entry barriers to agricultural production, it is not difficult for the producer to enter the marketplace.

Advantages and Disadvantages of Perfect Competition

Advantages

- It provides a practical framework for designing market activities

- It illustrates how manufacturers are inspired to offer lower prices

Disadvantages

- Perfect competition is a theoretical framework of a market economy. Although it provides a model that enables people to learn how the economy works, sometimes it is not correct and has significant variations from the real-world economy. The significance of perfect competition is only valid if it reflects the actual conditions in the market.

- Perfect competition has a low-profit margin. It is because all buyers can acquire the same product and drift naturally toward the lowest prices. Industries cannot separate themselves from others by charging high costs for superior products and services.

- There is no Innovation. The possibility of a firm having a significant market share and separating itself from the competition is a catalyst for the firm to innovate and produce quality products. However, in perfect competition, all market shares are equal for all firms, so there is no long-term profitability.

- Lack of Economies of Scale. The profit margin in a perfect economy is limited to zero, meaning that organizations have less capital to invest in enlarging their production ability. Production capabilities expansion could lower consumer costs and raise the firm’s profit margin. But many small vendors flooding the market for the same product in a perfect market prevents growth and ensures that the average business remains small.

Example of Perfect Competition

Perfect competition is a theoretical framework that doesn’t exist in the real market. It is a challenge to find an example of perfect competition in real life, but there are variations in society.

- Supermarkets

Consider a situation where two competing supermarkets stock their products from the same companies. In this scenario, there will be little or no information to differentiate the product from one another in both supermarkets, and still, their price will almost be the same.

- Knockoffs

In most cases, product knockoffs are priced the same way, and there is little to distinguish one from the other.

- Technology

There is a percentage of perfect competition in developing a new technology market. For example, many sites offered the same services during the initial days of social media networks. The market share was equal, and buyers were mainly young people. The start-up capital for these firms was less, meaning that companies could enter and exit the market freely.

Special offer! Get 20% discount on your first order. Promo code: SAVE20