Estimate the value of IDX per share using a discounted FCF approach

IDX Technologies is a privately held developer of advanced security systems based in Chicago. As part of your business development strategy, in late 2008 you initiate discussions with IDX’s founder about the possibility of acquiring the business at the end of 2008. Estimate the value of IDX per share using a discounted FCF approach and the following data:

¦ Debt: $30 million

Elevate Your Writing with Our Free Writing Tools!

Did you know that we provide a free essay and speech generator, plagiarism checker, summarizer, paraphraser, and other writing tools for free?

Access Free Writing Tools¦ Excess cash: $110 million

¦ Shares outstanding: 50 million

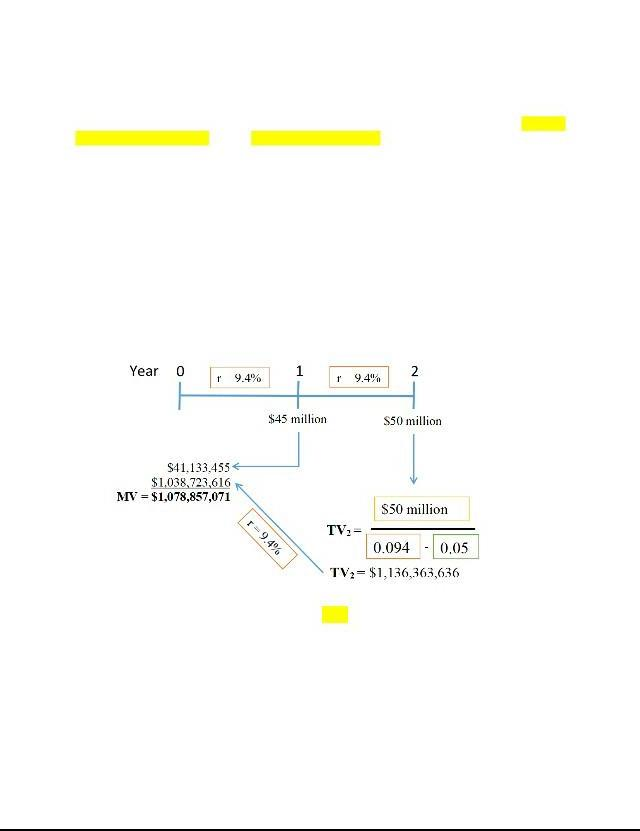

¦ Expected FCF in 2009: $45 million

¦ Expected FCF in 2010: $50 million

¦ Future FCF growth rate beyond 2010: 5%

¦ Weighted-average cost of capital: 9.4%

IDX Technologies is a privately held developer of advanced sec., systems based in Chicago. As part of your business development strategy, in late 2008 you initiate discussions with 1DX’s founder about the possibility of acquiring the business at the end of 2008. Estimate the value of IDX per share using a discounted FCF approach and the following data:

Explanation

Expected FCF in 2009(FCF1) = $45 million

Expected FCF in 2010(FCF2) = $50 million

Future FCF growth rate beyond 2010(g) = 5%

Weighted Average Cost of Capital(WACC) = 9.4%

Calculating Enterprise Value in 2008:-

Market value of equity = MV of firm + cash – MV of debt = $1,078,857,071 + $110 million – $30 million = $1,158,857,071

Value per share = MV of equity / # of shares

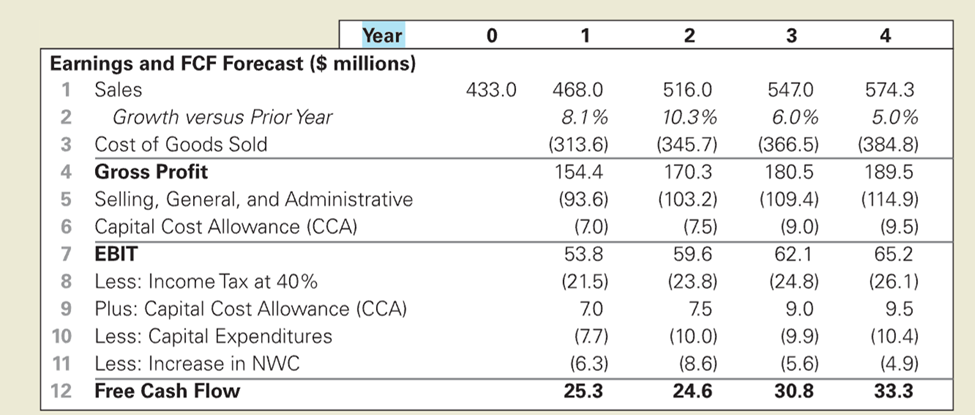

2. Sora Industries has 60 million outstanding shares, $120 million in debt, $40 million in cash, and the following projected free cash flow for the next four years:

a. Suppose Soras revenue and free cash flow are expected to grow at a 5% rate beyond year 4. If Soras weighted average cost of capital is 10%, what is the value of Soras stock based on this information?

Answer; Your company’s shares are currently worth a total of 117.35 million dollars. The value of your stock can be calculated as follows:. Value of stock = FCF1, FCF2, FCFN, WACC, $30.8 million, $33.3 million, and $24.6 million.

Step by Step Explanation

- Your company’s shares are currently worth a total of 117.35 million dollars. In order to determine how much your stock is worth, you must first discount the expected free cash flows of the company by applying the weighted average cost of capital.The formula that you can use is as follows:

- The value of the stock can be calculated as follows: Value of “stock=FCF1/(1+WACC)+FCF2/(1+WACC)2+…+FCFN/(1+WACC)NwhereFCF1, FCF2,…, andFCFN”are the expected free cash flows for the company for years 1,2,…, and N,and WACC is the weighted average cost of capital.

- In this scenario, FCF1 is equal to $25.3 million, FCF2 is equal to $24.6 million, FCF3 is equal to $30.8 million, FCF4 is equal to $33.3 million, and N is equal to 4. In addition to this, we are aware that WACC equals ten percent. After entering these numbers into the formula, we get the following results:

- Value of stock equals $25.3 million divided by one plus ten percent, plus $24.6 million divided by one plus ten percent. 2 + $30.8 million / (1 + 10 percent) 3 + $33.3 million / (1 + 10 percent) 4 = $25.3 million / 1.1 + $24.6 million / 1.12 + $30.8 million / 1.13 + $33.3 million / 1.14 = $23.0 million + $21.8 million + $20.1 million + $18.9 million = $117.35 million Therefore, the value of your stock is calculated to be $117.35 million dollars.

b. Soras cost of goods sold was assumed to be 67% of sales. If its cost of goods sold is actually 70% of sales, how would the estimate of the stocks value change?

Answer; The annual rate of expansion would fall to 7.9 percent from 8.2 percent. The proportion of sales that went toward the cost of goods sold would rise to 71.4 percent. If this were to happen, EBIT would amount to 14.3 percent of sales.

Step by Step Explanation

- If the cost of goods sold is in fact equal to seventy percent of sales, then the following adjustments need to be made to the valuation of the stock: The number of sales would not change. The annual rate of expansion would fall to 7.9 percent from 8.2 percent.

- The proportion of sales that went toward the cost of goods sold would rise to 71.4 percent. The gross profit as a percentage of sales would fall to 28.6 percent. Expenses related to selling, general administration, and administration would stay the same. The capital cost allowance would be maintained at its current level. If this were to happen, EBIT would amount to 14.3 percent of sales.

- The percentage of revenue collected in the form of income tax would drop to 5.7%. The capital cost allowance would be maintained at its current level. The amount of money spent on capital projects would not change. The increase in NWC would not change in any way. The percentage of sales that would be covered by free cash flow would drop to 20.6%.

c. Lets return to the assumptions of part (a) and suppose Sora can maintain its cost of goods sold at 67% of sales. However, now suppose Sora reduces its selling, general, and administrative expenses from 20% of sales to 16% of sales. What stock price would you estimate now? (Assume no other expenses, except taxes, are affected.)

Answer; Sora would have more money available to pay dividends and repurchase shares. The company’s free cash flow would rise from $25.3 million to $30.8 million as a result. The price-to-earnings ratio of the company would go from 120 to 100 if this happened.

Step by Step Explanation

- The company would have more money available to pay dividends to shareholders and to repurchase shares, both of which would cause an increase in the price of Sora’s stock. The free cash flow of the company would rise from $25.3 million to $30.8 million as a result of this change.

- Additionally, the company’s earnings would rise from $1 million to $1.2 million as a result of this scenario. The price-to-earnings ratio of the company would go from 120 to 100 if this happened. In order to compute the new stock price, we need to make an estimate of the dividend payout ratio and the share repurchase rate that the company maintains.

- On the basis of the information provided, we have come to the conclusion that the company will maintain its dividend payout ratio at the current level of 20 percent, while simultaneously increasing its share repurchase rate from 5 percent to 10 percent. As a consequence of this, the price of one share of stock is now $12.50.

*d. Soras net working capital needs were estimated to be 18% of sales (which is their current level in year 0). If Sora can reduce this requirement to 12% of sales starting in year 1, but all other assumptions remain as in part (a), what stock price do you estimate for Sora? (Hint: This change will have the largest impact on Soras free cash flow in year 1.)

Answer; Sora’s net working capital requirements are expected to have the greatest effect on the company’s free cash flow in the first year.The company’s value would rise from $120 million to $133 million if the company is able to lower its working-capital requirements.

Step by Step Explanation

- Assuming that Sora is able to lower its net working capital requirements from 18 percent of sales to 12 percent of sales beginning in year 1, the company’s free cash flow would increase from $25.3 million to $33.3 million in year 1. Because of this, the value of the company’s stock would rise from $120 million to $133 million as a consequence.

- Changes in Sora’s net working capital requirements are expected to have the greatest effect on the company’s free cash flow in the first year. This is due to the fact that a decrease in the amount of networking capital that is required will result in an increase in cash flow from operations.

- The impact of the reduction in net working capital requirements will have less of an effect in year 2, due to the fact that the increase in cash flow from operations will be cancelled out by the increase in capital expenditures. In year 3, the impact of the reduction in net working capital requirements will be even less significant than it was in year 2, due to the fact that the increase in cash flow from operations will be offset by the increase in capital expenditures and the decrease in net working capital.

- In year 4, the impact of the reduction in requirements for net working capital will have a negative impact because the increase in cash flow from operations will be offset by the increase in capital expenditures and the reduction in net working capital requirements.

3.Consider the valuation of Kenneth Cole Productions in Example 9.7.

| 2005 | ||

| FCF Forecasts ($millions) | ||

| 1. Sales | ||

| 2. growth vs. prior year | ||

| 3. EBIT | 9.00% of sales | |

| 4. Less: Income Tax | 37.00% of EBIT | |

| 5. Less: Net Investment | 8.00% of change of sales | |

| 6. Less: Increase in NWC | 10.00% change of sales | |

| 7. Free Cash Flow | ||

| 8. Terminal Value |

| 9. PV of Free cash flows | 424.83 | |

| 10. Value of Cash | 100.00 | |

| 11. Value of Debt | 3.00 | |

| 12. Number of shares | 21 |

| 13. Share price | 24.85 |

Step-by-Step explanation

The Revenue Growth Rate (RGR) is a measure of a company’s ability to increase sales revenue over time. While revenue is a numerical value, revenue growth rates compare current sales statistics (total revenue) to earlier periods (typically quarter to quarter or year to year).

a. Suppose you believe KCPs initial revenue growth rate will be between 4% and 11% (with growth slowing in equal steps to 4% by year 2011). What range of share prices for KCP is consistent with these forecasts?

Answer; If Initial Revenue Growth Rate can vary between 4% and 11%, the stock price can vary between

b. Suppose you believe KCPs EBIT margin will be between 7% and 10% of sales. What range of share prices for KCP is consistent with these forecasts (keeping KCPs initial revenue growth at 9%)?

Answer; b. If EBIT Margin can vary between 7% and 10%, the stock price can vary between

c. Suppose you believe KCPs weighted average cost of capital is between 10% and 12%. What range of share prices for KCP is consistent with these forecasts (keeping KCPs initial revenue growth and EBIT margin at 9%)?

Answer; c. if weighted average cost of capital can vary between 10% and 12%, stock value can vary between

d. What range of share prices is consistent if you vary the estimates as in parts (a), (b), and (c) simultaneously?

Answer; If all three of the above can vary, the stock price can vary between

4.You notice that PepsiCo has a stock price of $52.66 and EPS of $3.20. Its competitor, the Coca-Cola Company, has EPS of $2.49. Estimate the value of a share of Coca-Cola stock using only this data.

Answer; PepsiCo P/E = 52.66/3.20 = 16.46x. Apply to Coca-Cola: share price of coca cola EPSX P/E = $2.49 ×16.46 = $40.98.

P/E ratio = price per share / earning per share 16.46 = price /2.49 price = 2.49 x16.46

5.Suppose that in January 2006, Kenneth Cole Productions had EPS of $1.65 and a book value of equity of $12.05 per share.

a. Using the average P/E multiple in Table 9.1, estimate KCPs share price.

Answer; a. Share price = Average P/E × KCP EPS = 15.01 × $1.65 = $24.77

b. What range of share prices do you estimate based on the highest and lowest P/E multiples in Table 9.1?

Answer; b. Minimum = 8.66 × $1.65 = $14.29, Maximum = 22.62 × $1.65 = $37.32

c. Using the average price to book value multiple in Table 9.1, estimate KCPs share price.

Answer; c. 2.84 × $12.05 = $34.22

d. What range of share prices do you estimate based on the highest and lowest price to book value multiples in Table 9.1?

Answer; d. 1.12 × $12.05 = $13.50, 8.11 × $12.05 = $97.73

Perhaps you may find interest in answered questions on chamberlain.

Special offer! Get 20% discount on your first order. Promo code: SAVE20