Types of Accounting

The world of accounting has a variety of vocabularies and terms for the various types of accounting, but it is important to be familiar with the different types so that you can make an informed decision about your future profession. In this article, we will discuss the different types of accounting and what they have in common.

Elevate Your Writing with Our Free Writing Tools!

Did you know that we provide a free essay and speech generator, plagiarism checker, summarizer, paraphraser, and other writing tools for free?

Access Free Writing ToolsGet to understand the pros and cons of accounting.

What is Accounting?

Accounting is the process that records, analyzes, and reports economic data about a business. It requires special training to be able to solve complex problems and make accurate decisions. The primary job of accounting professionals is to provide financial information to investors, lenders, and other businesses in the industry.

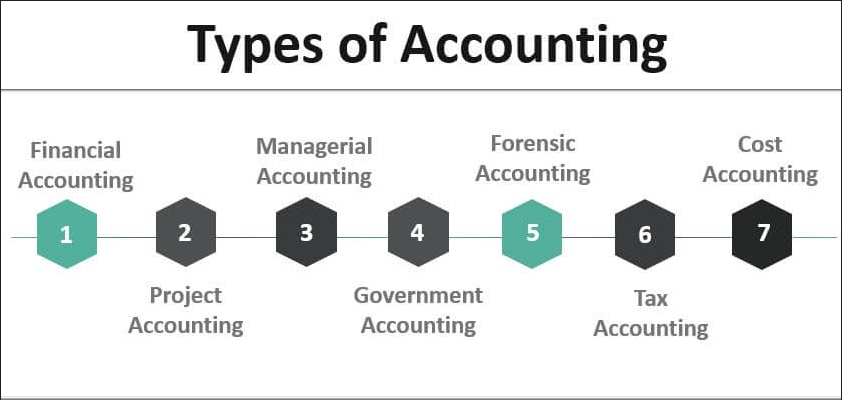

Types of Accounting

The following are the most common types of accounting. If you have a hard time understanding and tackling your accounting assignments, online accounting homework help is here for you. You will get help completing your accounting assignments and also learn tips on how you can handle your assignments in the best way possible.

1. Managerial Accounting

Managerial accounting is the process of collecting, analyzing, and reporting accounting information for internal use that provides the decision-making facility. It primarily serves to report information to managers to help them make decisions on what actions are needed.

Managerial accounting is also used as an internal tool to make sure that the organization is being run efficiently. Managerial accounting has three pillars: decision making, controlling and planning. Other functions of managerial accounting include; asset management, treasury, and management advisory.

2. Financial Accounting

Financial accounting includes three main components: balance sheet, income statement, and cash flow statement. It is primarily used to provide financial statements for comparison with other businesses such as performance against goals and indicators of economic health. This information is widely used by investors and lenders to decide whether a business has the size to invest in or not.

There are two types of financial accounting;

- Accrual accounting

- Cash accounting

Accrual accounting records all transactions as cash items in the financial statements. This is the most common accounting method used today.

Cash accounting is a very old method of accounting where assets and liabilities are recorded at the time of actual transactions. In this way, there is no need to create deferred assets such as loans or accounts receivable.

3. Auditing

Auditing is an independent assessment and verification of the financial statements of a business. This checks that the financial information is correct and conforms to relevant rules, regulations, and laws. Auditors conduct reviews, test, and measure the financial information with their professional expertise in order to ensure the accuracy of the data. They report on findings to ensure that management can make informed decisions on how to improve the organization.

There are four types of auditor opinions they include:

- The adverse opinion-adverse audit report

- Qualified opinion-qualified report

- Qualified opinion-qualified report

- Unqualified opinion-clean report

An example of auditing is your principal analyzing your grades to check if you have qualified to join college.

4. Cost Accounting

Cost accounting involves measuring and tracking costs of the production process. It originated from the field of industrial engineering, which is concerned with determining the time and resources necessary for specific operations to make efficient processes. Cost accountants are responsible for managing the budget and allocating resources so that it can be maximized at the lowest possible cost. They also use cost accounting data to drive strategic business decisions.

There are four types of cost accounting;

- Marginal accounting

- Standard cost accounting

- Lean accounting

- Activity-based accounting

Some objectives of cost accounting include: estimating the cost of goods sold, analyzing the profitability of a product, or removing unnecessary costs from the business.

5. Forensic Accounting

Forensic accounting is a specific form of investigation that involves the examination of past transactions and events in order to determine the cause of a problem affecting business operations. Forensic accounts are used to satisfy legal requirements such as proving someone’s innocence, putting the current company in the right location, and bankruptcy.

A forensic accountant must have exceptional expertise in accounting, finance, and law so he can perform a complete financial statement analysis and assume a leadership role in solving the problem.

6. Tax Accounting

Tax accounting involves the calculation of the amount of tax that a business is required to pay. In some countries, tax accountants are the ones responsible for filing the tax. They must make sure that they have enough information available on all transactions carried out by the business in order to properly calculate and report taxes due.

Tax accountants are also able to identify tax deductions that can be claimed as well as other strategies to reduce taxable income. The following are some benefits of tax accounting:

1. Assures taxpayers that their records are correct.

2. Assists in complying with legislative regulations and filing taxes.

3. Provides information on the performance of a company’s operations with taxes.

4. Helps in achieving better cash flow control due to proper planning for tax payment time and ways.

7. Public Accounting

Public accounting firms perform a wide variety of services to public and private sector organizations, government agencies, and not-for-profit organizations. Public accountants are responsible for reporting financial information to the public such as stockholders and banks. They must ensure that financial data is accurate so that it will represent the true picture of the business. The following are some roles of public accounting:

1. Advise company directors on their responsibilities.

2. Advise management and shareholders on ways to improve the performance of a business.

3. Ensure that financial reports are prepared according to relevant regulations, laws, and rules.

4. Provide assurance to the public that in the right hands their money is safe.

8. Accounting Information Systems

Accounting information system is defined as a system that supports accounting activities and information needs. It enables an organization to effectively manage its business and financial operations. Information requirements for financial reporting are updated, implemented, and stored on computer systems.

Accounting information systems use different types of programs to support various accounting needs such as transaction processing and analytical modules. This also includes automated data-capture devices and remote data capture devices.

What do all Accounting Types Have in Common?

In general, all accounting types have the same objectives. They include:

1. Measure and report financial transactions

2. Provide information for decision-making purposes

3. Comply with the legislation and regulations

4. Satisfy the financial needs of relevant parties

5. Enhance profitability of a business through better management practices

6. Reduce time spent on record-keeping activities through automation and computerization of accounting functions

All types of accounting are important to a firm’s financial health because it provides assurance that the figures on all financial transactions are accurate. Without these reports, proper judgment and decision-making would be impossible.

Accounting information systems are the core component of a firm’s business and financial management system because without them it would be impossible for an organization to accurately report its business decisions and performance.

Additional guides to help advance in Accounting;

Special offer! Get 20% discount on your first order. Promo code: SAVE20