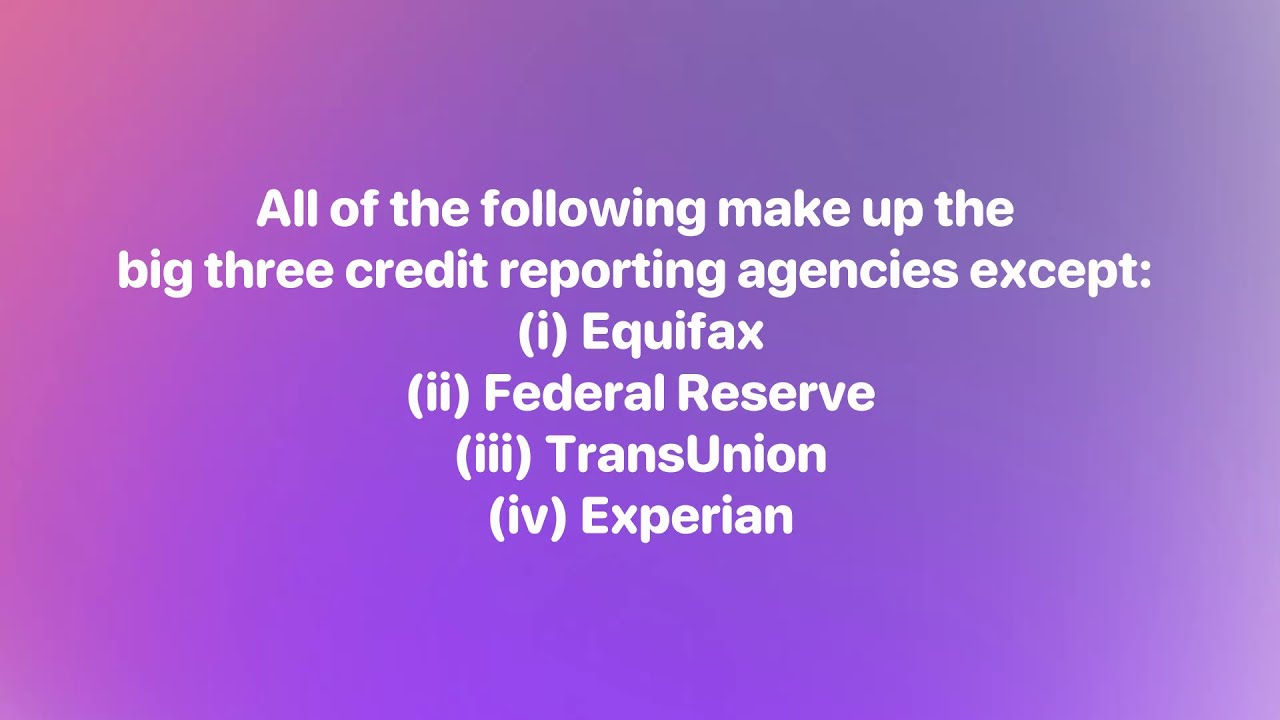

All of the following make up the big three credit reporting agencies except:

Question 1: All of the following make up the big three credit reporting agencies except:

A: Equifax

Elevate Your Writing with Our Free Writing Tools!

Did you know that we provide a free essay and speech generator, plagiarism checker, summarizer, paraphraser, and other writing tools for free?

Access Free Writing ToolsB: Federal Reserve.

C: Transunion

D: Experian

Answer; B: Federal Reserve.

Explanation:

The Federal Reserve is a central bank of the United States and is also responsible for supervising financial institutions and insuring bank deposits.

The Federal Reserve manages the finances of the United States, including setting monetary policy through the operation of a monetary policy committee and supervising banks and other thrift institutions that are members of the Federal Reserve System (and banks whose deposits are insured by the U.S. government).

Can I pay someone to do my economics homework? Yes, despite economics being very interesting, it is not an easy discipline. Most students often struggle to finalize their economics homework on time and that is why they prefer to pay someone to do their economics homework, quizzes or tests and relieve themselves from all the tussle.

What are Credit Reporting Agencies

Credit reporting agencies are organizations that collect, verify, and report information about consumers’ financial activities. They are composed of three major agencies: Equifax, Experian and TransUnion.

These agencies collect information on consumers from all around the country to help lenders who are searching for a reliable individual before they will grant them a loan or credit card.

List the 3 CRAs operating in America

- Equifax

- Experian

- TransUnion

Above are the three major credit bureaus operating in the United States.

What is a Federal Reserve

The Federal Reserve is the central bank of the United States. As such, it is responsible for conducting the nation’s monetary policy and supervising and regulating banking institutions.

The Federal Reserve was created by Congress in 1913, following the financial crisis that led to the passing of the Federal Reserve Act in 1913. Before then, all national banks were required to be members of, and therefore supervised by, an assigned Federal Reserve Bank.

Functions of the Federal Reserve System

The responsibilities of the federal reserve include:

1. To regulate the money supply

2. To conduct the nation’s monetary policy

3. To supervise and regulate banking institutions in the United States

4. To fulfill the Terms of Art obligations and other requirements of its charter

5. To provide interest on bank deposits by commercial banks

6. To collect fees for services provided to banking institutions by Federal Reserve Banks and for other services performed for the Board of Governors of the Federal Reserve System.

Question 2: Which of the following statements about credit scores is TRUE?

A. Credit scores reflect how likely individuals are to repay their debts.

B. Credit scores range from the low 300’s to the mid 800’s.

C. Each person has three credit scores.

D. All of the above.

Answer; A. credit scores reflect how likely individuals are to repay their debts

Question 3: Having a good credit score is important because:

A. It can impact your ability to get a driver’s license

B. It can impact your ability to be approved for bank loans

C. It can impact how much you will have to pay the government in taxes

D. It can impact how much you will have to pay for college

Answer; B. It can impact your ability to be approved for bank loans

Question 4: Which action can hurt your credit score?

I. Paying your phone bill late.

II. Taking the bus to work.

III. Maxing out several credit cards.

IV. Using the internet to pay your bills

- I

- I and II

- I and III

- III and IV

Answer; 3. I and III

Question 5: Jose wants to be sure he maintains a high credit score as he is planning to buy a new car soon. What should he do to ensure his score stays high, allowing him to buy his dream car?

A. Open a savings account at the local bank.

B. Pay off his credit card balance each month.

C. Test drive several cars before deciding which to buy.

D. All are things he should do to increase or maintain his credit score.

Answer; A. Open a savings account at the local bank.

Question 6: Which of the following actions can NEGATIVELY impact your credit score?

A. You disputed an item on your credit report.

B. You forgot to pay the cable bill.

C. You pay all your bills in cash.

D. You use a small amount of your available credit.

Answer; B. You pay all your bills in cash

Question 7: Which of the following actions has NO impact on your credit score?

A. You inquire about a credit card charge.

B. You use a large percentage of your credit limit.

C. You opened several new credit cards last week.

D. You send in your credit card payment a couple days late.

Answer; A. You inquire about a credit card charge.

Question 8: What can you do to make sure you have a healthy credit report?

A. Review your credit report each year.

B. Make sure everything on your credit report is correct.

C. Dispute any errors you find on your report with your credit agency.

D. All of the above.

Answer; D. All of the above.

Question 9: Which of the following MOST influences your credit score?

A. Types of Credit Used

B. Payment History

C. Length of Credit History

D. Amounts Owed

Answer; B. Payment History

Question 10: Which best explains what a credit score represents?

A. A number showing how likely you are to have more than one credit card.

B. A numerical rating that expresses how likely you are to repay your debts.

C. A numerical rating that shows how much money you have in your bank account.

Answer; B. A numerical rating that expresses how likely you are to repay your debts

Question 11: Which of the following actions would improve your credit score?

A. Closing out old credit cards

B. Paying off your credit card bill

C. Using a large portion of your credit limit

D. Opening a new savings account

Answer; B. Paying off your credit card bill

Question 12: In which of the following situations is having a good credit score important?

A. Buying a car.

B. Applying for a loan at a bank.

C. Renting an apartment.

D. All of the above.

Answer; D. All of the above.

Question 13: How many free credit reports are you legally entitled to each year?

A. One credit report each year

B. Three credit reports each year

C. One credit report from each credit bureau

D. Three credit reports from each credit bureau

Answer; C. One credit report from each credit bureau

Question 14: Having a low credit score can make it more difficult to:

A. Obtain a car loan

B. Open a new credit card

C. Secure an apartment lease

D. All of the above

Answer; D. All of the above

Question 15: Which behaviors might lead someone to have a low credit score?

A. Missing a car payment.

B. Having a long credit history.

C. Always buying the full balance of a credit card each month.

D. Having a debit card.

Answer; B. Having a long credit history.

Before rushing to handle your economics assignments ensure you familiarize yourself with the common issues that make most students fail in their economics papers.

Related Economics Questions

- Which of the following payment types require you to pay upfront?

- All of the following components are commonly found in rental housing agreements except:

- In a free-enterprise system, consumers decide?

- Which of the following is not a cost typically associated with owning a car?

- Which of the following types of financial aid do not require you to pay the money back?

- What is one benefit of purchasing saving bonds?

- Which of the following is a unique feature of credit unions?

- Which helps enable an oligopoly to form within a market?

- Which statement is not true regarding a straight life policy?

- Which of the following is an example of derived demand?

Special offer! Get 20% discount on your first order. Promo code: SAVE20