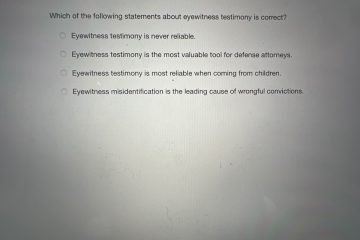

Which of the following is a unique feature of credit unions?

Which of the following is a unique feature of credit unions?

A. Credit unions are owned and operated by their participants.

Elevate Your Writing with Our Free Writing Tools!

Did you know that we provide a free essay and speech generator, plagiarism checker, summarizer, paraphraser, and other writing tools for free?

Access Free Writing ToolsB. Credit unions provide a huge variety of financial products and services akin to the banks.

C. Credit unions can have a large pool of members as membership is not restricted to certain groups or communities.

D. Both A and C.

Answer; D. Both A and C

Which of the following is a unique feature of credit unions?

A) Credit unions are typically owned and run by their members.

B) Credit unions limit membership to certain people or groups.

C ) Credit unions offer a wide variety of banking services.

D ) Both A & B

Answer; D. Both A & B

Are you spending too much time handling your economics assignments and end up not getting the desired results? Seek economics assignment help from Gudwriter and relieve yourself all the burden. The complexity of the topic you are working on should not be an issue since our professional writers are conversant with any economics related topic and will guarantee you quality solutions.

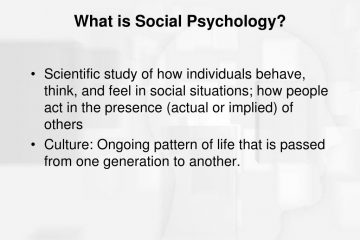

What is a Credit Union?

A credit union (CU) is a not-for-profit, cooperative financial institution that provides many banking and lending products to its members. Credit unions are owned by the people who use them, which means they have a vested interest in the success of their CU.

Credit unions offer their members an alternative to large banks and can provide the same services at lower rates because they don’t have outside shareholders demanding high returns on investments.

Characteristics of The Best Credit Unions

Best credit unions have the following characteristics:

1. Automatic transfer

The best credit union should offer a convenient way to transfer funds into savings.

Best credit unions will have a designated automatic transfer feature that will automatically move saved money into your savings account at a predetermined time of the month. The best CUs also offer an option not to make the transfer if desired.

Best CUs also give their members choices other than ACH transfers, such as checks, payroll deductions, or direct deposit for transferring funds from checking to saving accounts.

2. Lending rates

The best credit union will have very low rates of interest on loans and other products.

Credit unions usually offer some of the lowest rates in the lending business. Generally, they charge smaller amounts for credit than banks, are generally more flexible with terms and conditions, and usually don’t charge fees such as a check fee.

3. Membership fee

The best credit union will not charge a sizeable membership fee.

The best CUs don’t require their members to pay a large amount for joining the CU. Top credit unions don’t charge their members anything for becoming a member and enjoying the benefits that come with it.

Best CUs also offer a grace period for first-time savings account deposits and don’t charge service fees for opening accounts, making deposits or withdrawals, or writing checks.

4. Savings rates

The best credit union offers attractive savings rates.

The best credit unions will offer their members a variety of ways to make higher amounts of money on their deposits. The best CUs will offer higher interest rates on particular products and services than other credit unions, as well as competitive rates compared to banks.

5. Credit card rewards program

The best credit union offers a loyalty program that includes rewards for being a member. Being a member may include receiving discounts on purchases, special deals on products and services in the credit union’s store, or other perks.

The best CUs offer some sort of loyalty reward program to encourage their members to become more involved; this usually involves discounts based on having a balance in savings or checking accounts, or privileges such as getting preferred rates on loans and mortgages.

Understand the basic economics concepts and reasons as to why you should study economics.

Advantages of Credit Union

Credit unions offer several advantages over traditional banks because they are owned and controlled by their members:

- Members have an ownership stake in the credit union. Credit unions are not owned by bankers, shareholders, or anyone else outside of their membership, which means that credit unions are more accountable to the members.

- The average member has more control over a credit union than with a bank. Credit unions have fewer bureaucratic policies and hierarchies than banks, both in terms of decision-making and revenue allocations, making them more responsive to their members.

- Credit unions are not-for-profit. A credit union does not create profit for shareholders, bank managers, or CEOs at the expense of the membership or their interests. All revenue is used for the benefit of the member-owners.

- Credit unions are more likely to be community oriented. Credit unions are a more direct and visible part of the community in which they operate. Credit unions are able to reach out more easily to their members because they are owned by people who use the CU.

- Many credit unions rescue local businesses, helping them get back on their feet after natural disasters or other economic difficulties. Through this type of assistance and routine services such as check writing, credit unions provide financial services to members who otherwise would be unable to.

Disadvantages of Credit Union

Credit unions do not have the same advantages as banks when compared to retail banking.

- Credit unions generally do not offer mortgages, auto loans, or other installment loans. Many credit unions rely on member deposits and savings for most of their lending.

- Credit unions only offer checking accounts, which are sometimes called savings accounts in addition to savings accounts. Credit unions make money through the interest they earn on their deposits, but these earnings are restricted to the maximum amount that can be loaned out. This means that the interest earned is usually not as much as banks can earn on loans.

- Credit unions do not offer significant non-banking services such as investment services, stock investments, or tax and legal services.

- Credit unions do not have a nationwide network to which members can draw funds by writing checks.

Why You Should Use Credit Union

The following are reasons why you should consider using z credit union:

1. Higher savings rates

Credit unions have higher savings rates than banks. You will enjoy relatively high rates of return for your money, often surpassing the rate offered by a traditional bank.

2. More personalized service

Credit unions don’t have as many branches and ATMs as banks, which tends to mean less business and more personal service from your credit union representative.

3. Accessibility

Credit unions are more accessible than traditional banks in almost every way imaginable: services offered, products on sale, and employment opportunities.

How Does a Credit Union Differ From a Bank?

A credit union and a bank are very different in terms of size and organization.

- Credit unions are small and were originally designed to serve the needs of farm, labor, and credit unions. However, these days most credit unions have a much broader membership.

- Credit unions usually do not have branches, ATMs or other self-service facilities like banks do. This is because credit unions typically rely on face-to-face contact with their members rather than technology.

- Credit unions are not-for-profit institutions and are owned by the people that use them. By contrast, banks turn a profit for their shareholders and managers, who may be based thousands of miles away from the local branch.

Credit unions and banks both fulfill the same basic purpose, which is to give people access to financial services. Although banks are larger and more widely used than credit unions, credit unions have several advantages over banks, including greater accessibility and personalized service.

Credit unions also tend to offer higher savings rates than banks. The best thing you can do is research a credit union for yourself so that you can be sure that it is going to be the perfect match for your financial needs.

Related Economics Questions

- Which of the following payment types require you to pay upfront?

- All of the following components are commonly found in rental housing agreements except:

- In a free-enterprise system, consumers decide?

- Which of the following is not a cost typically associated with owning a car?

- Which of the following types of financial aid do not require you to pay the money back?

- What is one benefit of purchasing saving bonds?

- Which helps enable an oligopoly to form within a market?

- All of the following make up the big three credit reporting agencies except:

- Which statement is not true regarding a straight life policy?

- Which of the following is an example of derived demand?

Special offer! Get 20% discount on your first order. Promo code: SAVE20