All of the following components are commonly found in rental housing agreements except:

All of the following components are commonly found in rental housing agreements except:

A. Whether the renter can have pets in the house.

Elevate Your Writing with Our Free Writing Tools!

Did you know that we provide a free essay and speech generator, plagiarism checker, summarizer, paraphraser, and other writing tools for free?

Access Free Writing ToolsB. How much the renter will pay.

C. What type of renter’s insurance the renter must buy

D. Which repair types the renter will be responsible for.

Answer; C: What type of renter’s insurance the renter must buy

Economics is a wide subject that requires adequate research especially when you are trying to get answers to some complex questions and topics. This becomes a challenge to most students but one can relieve himself from all this by getting help with economics homework from a reputable service like Gudwriter that has a team of quaified experts.

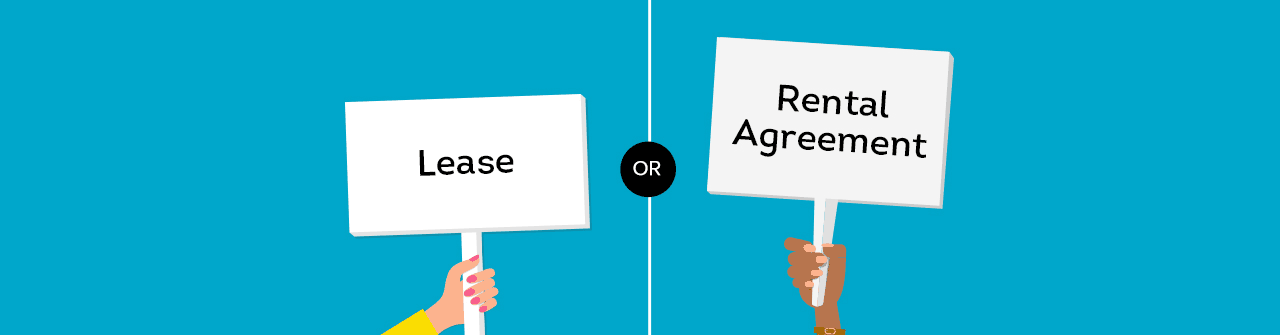

What is a Rental House Agreement?

A rental house agreement is a contractual arrangement between a landlord and a tenant. The contract should contain all the details of both parties so that they are in agreement regarding the property being rented out. It also specifies the terms of occupancy, the compensation, and other arrangements, according to need.

What’s Included in a Rental House Agreement?

A rental house agreement should include:

1. Occupancy Limits

The occupancy limits are the number of people who will occupy the house and how long they can stay on the premises. Normally, one adult is allowed to occupy a room as long as it doesn’t exceed the maximum occupancy limit. Some restrictions apply for pets and children, to ensure that both parties are aware of the conditions under which they should live on the property.

2. Terms of Occupancy

For a private lease and tenancy agreement, both the landlord and the tenant must agree on the occupancy period. But for an assured tenancy and housing contract, it is the landlord who sets aside an occupancy period for a fixed term.

The amount of time a tenant will stay in the property should be agreed upon during the occupancy period. And since there are always disagreements between both parties, to avoid any problems down the road, this should be clearly outlined in writing.

3. Occupant’s Responsibilities

Both the landlord and the tenant must know their responsibilities. The tenant should understand what his or her duties are when it comes to taking care of the property, paying rent on time, and other obligations.

The landlord, on the other hand, should be able to determine whether or not his/her rules were followed by the tenant as he/she also has rights upon making a rental house agreement.

4. Compensation

Rental house agreements should include a rental fee and the frequency of payments. It is also important to include other arrangements such as the penalties for late payments, late inspections, pets, and damages.

5. Notice Requirements

Different notices must be given by both parties before terminating the contract early, before, or during a lease or tenancy period. The landlord should be aware of these notices so that he/she can prepare accordingly and if necessary, file a lawsuit against the tenant for breaking the rules in the contract.

Explore how some urban housing reforms of the late nineteenth century eventually add to urban blight.

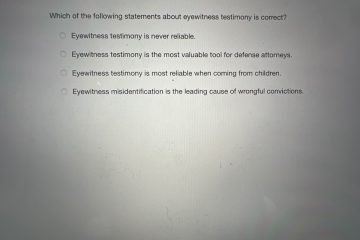

Why is Renters Insurance Excluded from a Rental House Agreement?

Generally, a rental house agreement doesn’t include this kind of coverage because typically it’s sold separately by the insurance company. However, if you live in a property that is covered under this type of policy and are an occupant of one of the units, your landlord would be required to obtain your consent to include this kind of coverage before signing off on the lease agreement.

Factors that Impact Renters Insurance

There are several factors that will affect whether or not a renter’s insurance policy is required. These include:

1. Personal Property Coverage

Personal property coverage protects the renter’s personal belongings from accidental loss and damage. Some insurance companies don’t offer this kind of coverage because it is expensive to operate a rental house in comparison to renting out a condominium. However, if a renter owns furniture or other possessions that are considered personal property, the renter will be required to obtain an additional policy to cover those items.

2. Liability Coverage

Liability coverage protects the renter from being held responsible for injuries or damages that are sustained by a tenant or by someone else on the property. For example, if a tenant slips and falls and dies on the property, the lease agreement would require the landlord to pay for the accidental damage, but the renter would be considered responsible for providing compensation for any unexpected health or medical costs related to their death.

3. Residence Type

Renters are typically limited to a specific residence type, such as an apartment, townhome, or condominium. There are also small differences in the coverage offered for each residence. For example, a rental home that mainly caters to college students in the area would be covered under a different policy than one that mostly caters to families with young children.

4. Property Location

Property location is another important factor that impacts renters’ insurance. In general, a tenant is required to carry coverage no matter where they live. If a landlord lives in an apartment that is located in the city and owns a vehicle, they will be required to have liability coverage on their car.

Question 2: A typical housing lease may require a tenant to:

A. Repair certain types of damage to the property

B. Purchase renter’s insurance for the property

C. Avoid participating in illegal activity on the property

D. Both A & B

E. All of the above

Answer; E. All of the above

Question 3: Which best describes the benefits of renting a home?

A. Renting can cost more upfront.

B. Renting is less flexible than owning a home.

C. Renting has a lease that costs money to break.

D. None of the above.

Answer; D. None of the above.

Explanation;

Renting has a lot of benefits, especially for people whose job requires travel or a job that needs to be relocated most of the time. Renting can be more flexible than owning a home in a specific place or location. Renting is also cheaper than owning a home/house since the payment is lower than the house payment.

The Benefits Of Renting A Home

1. Less risky compared to owning a home

Renting is riskier than owning a home. Most people rent because they cannot afford to buy one. If you rent and something happens to your property, you are not liable for damages. After all, the landlord can reclaim back their money from you and it is up to the owner whether they want to pay the expenses or not.

2. Less expensive

Renting is generally more affordable than buying a home even in areas like San Francisco which is one of the most expensive places in the world to live. If a person wishes to invest in a home, he or she can choose to buy a property instead of renting one.

However, renting is cheaper than buying, and even the interest while being in debt is also affordable. This is true especially if you have a good credit score. Those with bad credit will be charged higher interest rates than those who have a good credit score.

3. More flexible

Renting gives you more flexibility than buying a home. You are not locked into a house that makes you feel like you are in prison. A nice house can make people get comfortable and lazy. It is important to be able to get out there and do things. You can move to another house without being in debt. This is beneficial especially if you have a job that needs to be relocated.

4. No maintenance costs

When you own a house, you have to deal with maintenance costs that include cleaning and repairing the property. As a renter, on the other hand, you do not have this stress and it is less expensive than having to maintain something that you bought with your own money.

Disadvantages of Renting a Home

1. You do not own the Property

Renting is not owning a home. This is because when you rent, you have to pay for the property every month and get out of it after a certain amount of time. However, if you own your own home, you are in charge of the property and it is yours forever until you sell it or give it away. Once you do the latter, money will be returned to the bank since they covered their losses while your house was in use.

2. You do not get tax benefits

When you own a house, you get it free of charge while the government gives you a certain amount of tax benefits because of it. However, when you rent, you are responsible for the payment of rent and therefore have to pay taxes on your money.

Many people choose to rent instead of owning a home rather than spending the rest of their life in debt while they have to make payments and never break even. This is because they want to stay out from being in debt forever. Also, when you rent, you can choose to buy a house or not and this is a big choice for many people.

3. You are in debt if you do not pay your rent

If you fail to pay rent, the landlord will issue a notice and send it to your landlord. If you do not pay, the landlord will have to take steps to collect back their expenses for the time that you have used their house and this includes your security deposit as well as other expenses.

4. You might not get the same space as a homeowner

When you own a house, you are in charge of it. As an owner, you have more room and space compared to renters. However, when you rent, it is only the landlord who manages the house while you are actually in control of your space. This makes renting look like a better option where you can have the same amount of space as homeowners or even more than them.

Question 4: Which combination of factors would result in the lowest monthly mortgage payment?

A.) Big down payment, a longer term loan, and a low interest rate

B.) Big down payment, a shorter term loan, and high interest rate

C.) Small down payment, a shorter term loan, and high interest rate

D.) Small down payment, a shorter term loan, and small interest rate

Answer; A) Big down payment, a longer term loan, and a low interest rate.

Ways to keep your mortgage payment as low as possible

1. Big down payment

Down payment is the amount of money you have in savings before your lender will give you a loan. This is usually put down towards a house, but it is possible to use it on other types of loans. Making a big down payment will keep your mortgage payment low because the amount you pay on your house payment is less than the interest you will be paying on your loan.

2. Longer term loan

A longer term loan means your mortgage will be paid off in a shorter time frame. When you think about this in terms of your house payment, the smaller it is, the lower your monthly payments will be. It is recommended that you use a term that is at least 10 years long when purchasing a house.

3. Low interest rate

When a loan has a low interest rate, it means you are paying less over time as you are paying off your loan. This is also another way to keep your mortgage payment low.

The main point of buying a house is to make it into a profitable investment that will help you build equity within the real estate market. When trying to keep your home mortgage low, it’s important to know that you want this investment to pay off in the end.

Factors Leading to Low Mortgage Payment

1. Improved credit scores

If you have a good credit score, you will be able to qualify for lower mortgage payments. This means that instead of having your monthly payment be around $1,500, it would be about $600. The reasons why one has a good credit score can include paying back debts and not defaulting on payments as well as maintaining a low ratio of debt to income.

2. Lower interest rates

Since the interest rate is based on the type of loan and how much money you are borrowing, there are ways that can reduce your interest rate even if your credit score is not good. You could opt for a refinance mortgage or use a home equity line of credit where you borrow against your property as collateral.

3. Reducing mortgage insurance

If you have good credit, you could get a new mortgage loan without having to pay private mortgage insurance. This can save you a lot of money since the PMI is based on the value of your home and is used to protect against loss by insurance companies in case you default on your payments. If your credit is not particularly good, then you may have no choice but to pay the PMI.

4. Dispute your property taxes

Your property taxes can have a lot of influence on your monthly mortgage payments. If you are able to dispute your taxes, then you could end up paying significantly less for them. You may be able to get some of the money back with the help of a tax dispute attorney.

Types of Mortgage Loans for Homebuyers

1. Conventional mortgage loans

A conventional mortgage loan that conforms to Fannie Mae or Freddie Mac, or a government agency standards. The loan features include a set rate that is fixed for the full term, and your payment may be adjustable. Advantages of taking up this loan include: The interest is usually lower since you are borrowing from your property as collateral; there is no PMI, which can save you some money; and the loan’s rate may be fixed for a longer period.

2. Government-backed loan options

These are loans that are made by the government, the Federal Housing Administration (FHA), and the Department of Veterans Affairs (VA). These loans are usually lower in interest rate and may give you a better deal.

3. Jumbo mortgage loans

Jumbo loans, also known as nonconforming loans, have borrowing limitations that are higher than those established for standard mortgages. The advantages of taking up this type of loan include:

- Even though the loan is bigger, the interest rate can still be modest

- They might enable the purchase of a more expensive house.

Related Economics Questions

- Which of the following payment types require you to pay upfront?

- In a free-enterprise system, consumers decide?

- Which of the following is not a cost typically associated with owning a car?

- Which of the following types of financial aid do not require you to pay the money back?

- What is one benefit of purchasing saving bonds?

- Which of the following is a unique feature of credit unions?

- Which helps enable an oligopoly to form within a market?

- All of the following make up the big three credit reporting agencies except:

- Which statement is not true regarding a straight life policy?

- Which of the following is an example of derived demand?

Special offer! Get 20% discount on your first order. Promo code: SAVE20