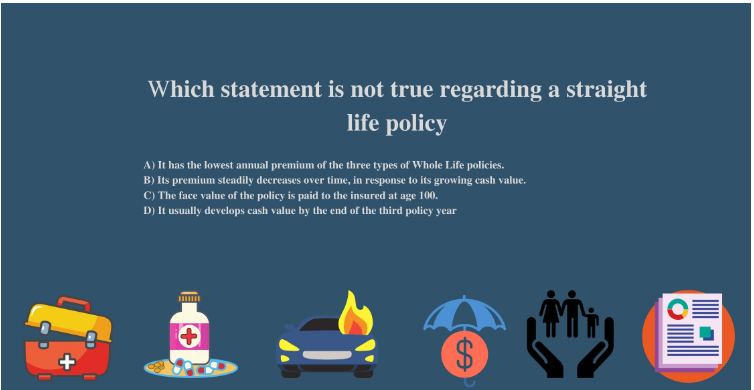

Which statement is not true regarding a straight life policy?

Which statement is not true regarding a straight life policy?

A) It has the lowest annual premium of the three types of whole-life policies.

Elevate Your Writing with Our Free Writing Tools!

Did you know that we provide a free essay and speech generator, plagiarism checker, summarizer, paraphraser, and other writing tools for free?

Access Free Writing ToolsB) Its premium steadily decreases over time, in response to its growing cash value.

C) The face value of the policy is paid to the insured at age 100.

D) It usually develops cash value by the end of the third policy year.

Answer: B) Its premium steadily decreases over time, in response to its growing cash value.

Explanation: Straight Life policies charge a level annual premium throughout the insured’s lifetime and provide a level, guaranteed death benefit.

Get help with college economics homework from Gudwriter and guarantee your a distinct grade.

What is a straight life insurance policy?

This is a life insurance policy that provides coverage for your death. This type of policy does not provide any cash value and pays out a fixed amount of money regardless of how long the insured lives or how much money the insurance company has to invest.

What type of premium does a straight life policy have?

The premium for a straight life policy is fixed and does not increase with age. It covers your life for a chosen period of time, during which only the death of the insured will pay out any benefit.

For instance, you have a $150,000 straight life insurance policy, which you are supposed to pay $40 a month. You will be paying $40 your entire life.

Pros and cons of a straight life policy

Pros

1. Fixed premiums

Straight life insurance policies have fixed premiums and therefore offer cash flow predictability. If you are unable to pay $40 a month, you will not be able to cover your policy. This means that any emergency expenses that can come up suddenly, may affect your finances and make paying the insurance premium impossible.

2. Level death benefit

The death benefit is usually the same for a straight life insurance policy. This means that if you die earlier, your beneficiaries will receive more money than if you were to die later in life.

3. Can take a loan or surrender policy for cash value

If you pay the full premium for a life insurance policy and are unable to continue paying it, you can surrender the policy or take out a loan to cover your payment. This option is not available with a straight life insurance policy.

4. Guaranteed cash value growth

These policies guarantee that the cash value will be at least the sum insured upon surrender and in most cases, the cash value can grow for as long as you have the policy.

Economics is insightful and with a pool of skilled economics experts, we can write quality papers on different topics with ease.

Cons

1. Its more expensive than term insurance

The premiums for single premium policies are usually more expensive than term insurance policies. This is because the insurer has to pay for a large-scale investment portfolio, which will require a larger initial investment and thus a higher premium.

2. You cannot cash it in if you want or need to

Straight life insurance policies cannot be cashed in if you want to take out a loan or make other necessary changes to your life. However, term insurance policies can be converted into cash value if you choose to do so.

3. It’s not the best for short-term goals

Straight life insurance policies are not for short-term goals. If you want a policy for years or less, believe that interest rates will remain low, and have the possibility of additional cash reserves to invest in a portfolio, straight life insurance is most likely the best option for you.

Difference between straight life insurance vs. universal life policy

Straight life insurance policies are designed for those looking for protection and guaranteed cash value growth with little to no flexibility. Universal life policies are more flexible and allow you to change your premiums, death benefits, or other features to fit your needs.

Universal life insurance policies can be converted into cash values, surrendered for a partial or full death benefit, and even taken out as a loan.

Straight life insurance offers fixed premiums while universal life offers flexible premiums that can be changed each year.

Difference between straight life insurance vs. term life policy

Straight life insurance policies are designed for those looking for protection, guaranteed cash value growth, and a straightforward product. Term life is the simplest form of life insurance. It is a policy that lasts for a single term (or period) of time starting from one year up to 35 years.

Term life policies are more flexible and allow you to change your premiums based on your needs per year.

Straight life insurance policies are designed for those who want their loved ones to enjoy death benefits. Term life is designed for people who need the security of knowing that they will have coverage for a specific period of time. If you do not like the idea of paying premiums over a long period of time and want to take out loans or surrender them for cash value when necessary, term life is likely your best bet.

Related Economics Questions

- Which of the following payment types require you to pay upfront?

- All of the following components are commonly found in rental housing agreements except:

- In a free-enterprise system, consumers decide?

- Which of the following is not a cost typically associated with owning a car?

- Which of the following types of financial aid do not require you to pay the money back?

- What is one benefit of purchasing saving bonds?

- Which of the following is a unique feature of credit unions?

- Which helps enable an oligopoly to form within a market?

- All of the following make up the big three credit reporting agencies except:

- Which of the following is an example of derived demand?

Special offer! Get 20% discount on your first order. Promo code: SAVE20