How to Calculate Economic Profit

Every day business owners must decide whether a decision is worth their investment. Economic profit is what economists, business people, and investors aim to achieve. It includes both the cost of financial capital needed to start a business as well as the revenue gained from the sale of its products or services at market prices. It serves as a check on the extent to which a business is making investments that achieve its goals.

Elevate Your Writing with Our Free Writing Tools!

Did you know that we provide a free essay and speech generator, plagiarism checker, summarizer, paraphraser, and other writing tools for free?

Access Free Writing ToolsEconomic profit is the difference between the money made from selling an output and the price of all the inputs plus any opportunity costs. Economic profit is determined by subtracting opportunity costs and explicit costs from earned income.

Learn the types of accounting and some of the best accounting homework tips to help you tackle your accounting assignments.

Let’s get to it!

Benefits of Economic Profit

People venture into business intending to make profits. Therefore every business person is always on the lookout to know whether his or her business is making a loss or a profit. Benefits of economic profit include:

1. Economic profit is used to examine the performance of a business

Economic profits play an important role in helping different businesses understand how they are performing on both the operating and investing sides. To assess how a company is performing, it can compare its economic profits with those of other companies in the same industry or compare it with previous years’ figures.

2. Economic profit is used by companies for growth

Economic profits played an important role in growing many successful companies that are today household names. Businesses use economic profits as a starting point in growing their companies, and then reinvest any additional earnings into the business. In this way, economic profits can help to start a new business.

3. Economic profit is used to generate cash flows for a company

When businesses are profitable, they earn more cash than they spend on day-to-day operations, which they can then use for growth opportunities or to reward shareholders with dividends. Businesses with high economic profit margins can use this extra cash flow to finance expansion and provide financial floor support in times of economic uncertainty.

Besides understanding the benefits of Economic profit please explore the pros and cons of Accounting.

Limitations of Economic Profit

Although economic profit plays an important role in businesses it also has its flaws. The disadvantages of economic profit include:

1. Does not take into consideration several crucial financial factors

Economic profit does not include important financial aspects and transactions such as capital expenditure, interest income, provisions for taxation, and items of revenue such as royalties. Economic profit is therefore not an accurate measure of how a business is performing in the long term.

2. Challenging to estimate

It is difficult to estimate the cost of capital in order to calculate economic profit. Different companies have different methods of measuring their opportunity costs.

3. Does not take into account all costs

Economic profit does not factor in ancillary costs such as insurance and utility bills, which need to be covered as a part of day-to-day operations. It also fails to consider the large amount of time and money invested in researching, developing, and marketing an idea before it can become a profitable business venture.

What is Accounting Profit?

According to generally accepted accounting principles, accounting profit is a company’s entire revenue (GAAP). It comprises the outright costs of conducting business, such as depreciation, interest, and taxes, as well as operating expenses.

Economic Profit vs. Accounting Profit

Both economic and accounting profits are business gains. However, these two types of profits have their differences. Economic profit is the sum of all sales income less all opportunity costs from all inputs. On the other hand accounting profit is the sum of all the company earnings, including explicit costs. Here are the key differences between the two:

1. Economic profits include both explicit and implicit costs, while accounting profit is the profit gained after subtracting explicit costs.

2. Accounting profit indicates a company’s true profit while the economic profit indicates a company’s efficiency.

3. Economic profit calculation is done based on other measures that a company would have taken while running their business. While accounting profit calculates the actual occurrences in a business for a specific period.

How to Calculate Economic Profit

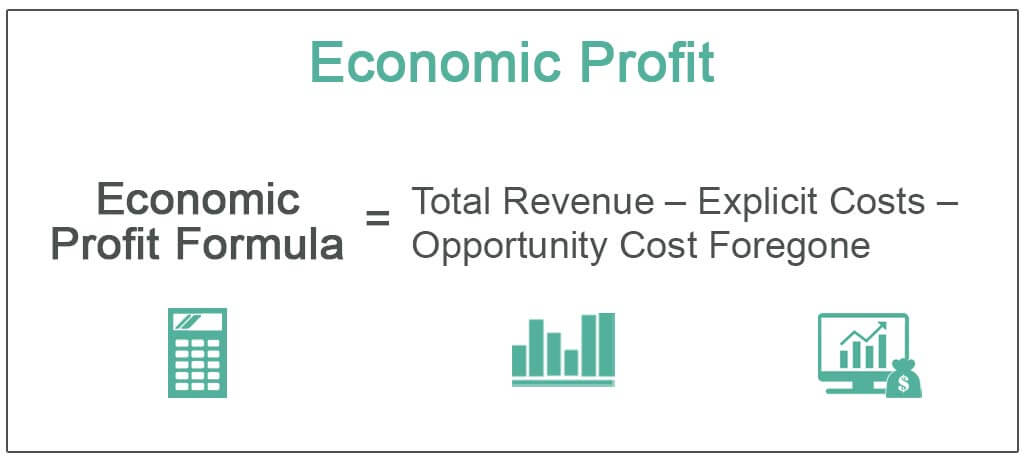

The economic profit formula is:

Economic profit = Total Revenues – Explicit Costs – Opportunity Costs

Example 1

James starts a business and gets startup costs of $120,000. After 6 months of operation, James’ business earns a total revenue of $160,000. James gets an accounting profit of $40,000, but if he stayed in his previous job he would have made $28,000 (opportunity cost). Therefore, James’ economic profit will be:

In this case Economic Profit will be calculated as;

Economic profit = Total Revenues – Explicit Costs – Opportunity Costs

Where;

Total Revenues – Explicit Costs = Accounting Profit

Economic profit = accounting profit – opportunity Costs

Accounting profit = $160,000 – $120,000 = $40,000

Opportunity Costs = $28,000

Economic profit = $40,000 – $28,000

=$12,000

From this example, you can see the answer is positive. This means that James was able to cover up the expenses and made some profit.

Example 2

Let’s assume that company ABZ makes a revenue of $15,000 on facial products. Explicit costs and implicit costs amount to $4,000 and $2,000 respectively. The economic profit in this case will be;

Economic profit = Total Revenues – Explicit Costs – Opportunity Costs

Total Revenues = $15,000

Explicit Costs = $4,000

Opportunity Costs = $2,000

Economic profit = $15,000-$4,000-$2,000

=$9,000

Remember that when you calculate economic cost you should always include the explicit and implicit costs.

How to Calculate Accounting Profit

The accounting profit formula is:

Accounting Profit = Total Revenue – Explicit Costs

Example 1

DJ NewFace. Music Company reported a total revenue of $600,000 and explicit costs of $350,000. Calculate the accounting profit of this company;

Accounting Profit = Total Revenue – Explicit Costs

Where;

Total Revenue = $600,000

Explicit Costs = $350,000

Accounting Profit = $600,000-$350,000

=$250,000

Example 2

Gudwriter aimed to determine the accounting profit of their magazine industry. Their recent annual report showed that Gudwriter had a total revenue of $600,000. During this financial period, the company incurred a cost of sales of $350,000, operating and SG&A expense of $100,000, the interest of $50,000, extra-ordinary loss of $30,000, and taxes of $20,000. Calculate the accounting profit generated by Gudwriter Company.

Accounting Profit = Total Revenue – Explicit Costs

Explicit Costs = Cost of Sales + Operating and SG&A Expense + Interest + Extraordinary Loss + Taxes

Explicit Costs = $350,000+$100,000+$50,000+$30,000+$20,000

=$550,000

Accounting Profit = Total Revenue – Explicit Costs

Where;

Total Revenue = $600,000

Explicit Costs = $550,000

Accounting Profit = $600,000-$550,000

=$50,000

The accounting profit is $50,000

Economic profit and accounting profit are two different measures used to evaluate the performance of a business. These two concepts are important to identify the profitability of a business and the reasons behind its success. Gudwriter has the best accounting homework help service to aid all students having a hard time tackling their accounting assignments. Contact us now and improve your grade.

Specialists at Gudwriter analyze your accounting assignments and provide you with the assistance that you need. Our staff of professionals has years of experience in providing accurate and comprehensive reports for all your accounting needs.

Advance your Accounting career by exploring the additional resources below;

- Supply Chain Management and Why Is It Important

- How to Develop Career Goals for Accountants

- Natural Monopoly

- Top Accounting Certifications

Special offer! Get 20% discount on your first order. Promo code: SAVE20