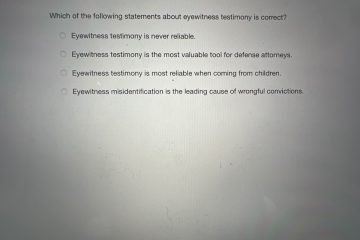

What is one benefit of purchasing saving bonds?

What is one benefit of purchasing saving bonds?

A. Saving bonds are purchased from the government and guaranteed to increase in value.

Elevate Your Writing with Our Free Writing Tools!

Did you know that we provide a free essay and speech generator, plagiarism checker, summarizer, paraphraser, and other writing tools for free?

Access Free Writing ToolsB. Saving bonds are purchased from commercial banks and guaranteed to increase in value.

C. Saving bonds are short-term investments backed by the government to protect from loss.

D. Saving bonds are long-term investments created to help first-time home buyers obtain a mortgage.

Answer; A. Saving bonds are purchased from the government and guaranteed to increase in value.

Do you have economics questions, tests or homework and wondering where you can get instant help? Worry no more! Gudwriter is your preferred economics homework helper that quarantees quality economics help for graduates and post-graduates students. Our team of qualified experts provide A+ solutions that will boost your grades.

What are Savings Bonds?

Savings bonds are a type of U.S. government-sponsored debt security providing individuals with a safe, secure, and convenient alternative to locking up their money for substantial periods in other kinds of securities.

Why are Savings Bonds so Popular?

Savings bonds are so popular for many reasons, including their safety (the U.S. government guarantees them), their versatility (savings bonds can be used to pay for almost anything), and their low risk (they have been issued since 1941, with no interruption since then).

How do I Set up a Savings Bond?

Setting up a savings bond is easy, to set up your savings bond, you need to access the Treasury direct” Here are steps to set up your treasury direct account:

1. Choose the type of account you are opening

If you would like to save money for college, you will likely want to open a 529 plan (you can learn more about these plans here). If you would like to save for your child’s education or retirement, then you will want to open a traditional account. When you first sign up for your new savings account, be sure to choose the type of savings bond account that is right for you (traditional or college savings).

2. Provide personal information

The second step of opening a savings bond account is providing personal information. This includes your email, Tax ID number ( SSN or EIN), routing number, and bank account.

3. Choose a password

The third step is to choose your password for the account. You will have to keep track of this password so you can sign in to your account at any time and view all of your accounts, including savings bonds.

The Advantages of Saving Bonds

The advantages include:

1. Savings bonds will always be worth at least their face value. Savings bonds do not have time limits like other tax-deferred investment accounts.

2. The interest earned on savings bonds is exempt from Federal income taxes, State and local taxes.

3. The interest rate of the bond is adjusted for inflation twice a year to maintain its purchasing power over time.

4. You can buy savings bonds in paper form or electronically through Treasury Direct, an online system operated by the U.S. Treasury.

5. Saving bonds can be exchanged for money in the savings bond program upon maturity if you are not able to redeem them at that time.

The Disadvantages of Saving Bonds

The disadvantages include:

1. The interest rate on savings bonds is not adjusted for inflation. This means that the purchasing power of your bonds will erode over time.

2. The value of U.S. Savings Bonds change in value as the U.S. Treasury sells them to pay for a national debt, which requires an increased cost to purchase savings bonds

3. Unlike CDs and IRAs, you can only hold one savings bond at a time, which prevents multiple family members from accessing the program at once (and potentially losing money).

4. The interest on the bond will not be taxed until you redeem the bond for cash, which can be inconvenient, especially if you would like to receive your interest every month.

5. The interest rate on savings bonds is not competitive when compared to other programs; however, it can potentially provide a higher return than CDs if you have a long time until maturity (be sure to check this).

Who Will Benefit from Savings Bonds?

Savings bonds can be beneficial to anyone who is looking for a safe way to save money. Depending on individual needs, savings bonds can be used for many different investing purposes. Examples of people who will benefit from the savings bond include:

1. Children: Kids can be one of the biggest beneficiaries if savings bonds are used for their needs. Children can use savings bonds to pay for education and other reasons. Parents will have peace of mind knowing that their savings are being well spent.

2. College students: College costs are rising at an alarming rate. Savings bonds can be used to help college students make it through the tough times and graduate without student loans.

3. Grandparents: It is important for seniors to have savings going forward to keep from being dependent on their grandkids. Retirees can benefit a lot when they get security like Treasury security. Retirees can keep their assets safe, gain interest in their investments, and many other things.

Savings bonds can be a great investment program for many people. If you are looking to save money, use a Treasury security to gain the best interest rate.

Related Economics Questions

- Which of the following payment types require you to pay upfront?

- All of the following components are commonly found in rental housing agreements except:

- In a free-enterprise system, consumers decide?

- Which of the following is not a cost typically associated with owning a car?

- Which of the following types of financial aid do not require you to pay the money back?

- Which of the following is a unique feature of credit unions?

- Which helps enable an oligopoly to form within a market?

- All of the following make up the big three credit reporting agencies except:

- Which statement is not true regarding a straight life policy?

- Which of the following is an example of derived demand?

Special offer! Get 20% discount on your first order. Promo code: SAVE20